To new

residents, property taxes are one of the most

misunderstood aspects of municipal government.

Complaints are often voiced to Township personnel that

the municipal property taxes are too high. In fact,

Dingman Township's municipal property taxes are among

the lowest in Pike County. The Dingman Township Board

of Supervisors constantly strives to keep municipal

property taxes as low as possible while still

maintaining quality services. The confusion stems from

the fact that while property taxes are collected by the

Dingman Township Tax Collector, the majority of the tax

money goes to the County and School District.

Dingman Township does NOT have an Earned Income

Tax

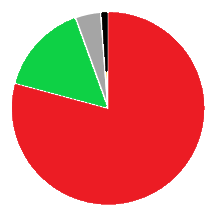

Your 2024 Tax Dollar

Red - Delaware Valley School District

117.83 mills

Green - Pike County

24.99 mills

Gray - Dingman Township

6.50 mills

Black - Dingman Township Fire and EMS9

1.75 mills. 3.08%

Delaware Valley School District -

113.85 mils, Green - 14.8% Pike County 21.24 mils, Blue

4% Dingman Township 6 mils, Purple 0.8% Fire Tax 1.25

mils, Black 0.1% Ambu

How the

Property Tax System Works

1. The

Pike County Tax Assessor determines the value of every

property in the county.

2. The

Pike County Commissioners determine the percentage of

the property value to be taxed. Currently, only 25% of

the assessed value is taxed.

3. The

taxing entities (Pike County, Delaware Valley School

District, and Dingman Township) create their annual

budgets and determine the amount of money that must be

raised through property taxes. The taxing entities then

determine the amount of millage they will need to

collect in order to raise that amount.

A mil is

equal to 1/1000 of a dollar. Therefore a property

assessed at $100,000.00 would be taxed based on

$25,000.00. A one mil tax rate result in a tax bill of

$25.00.

4. The

Dingman Township Tax Collector mails tax bills to the

property owners who in turn send their payments to the

Dingman Township Tax Collector.

5. The

Tax Collector sends the collected tax revenue to the

appropriate taxing entities.

Who Gets

What?

In 2024,

Delaware Valley School District taxed Dingman Township

property at a rate of 117.83 mils. Pike County set

a 24.99 mil rate, while Dingman Township kept its taxes

at 6.5 mils. There is also a 1.25 mil fire tax and

a .5 mil tax to help

support the two fire and two ambulance departments that serve the

Township. Based on these rates our hypothetical

$100,000.00 property would be expected to pay the

following:

|

2024 Taxes

assessed on a $100,000 house in Dingman Township

|

|

Taxing Entity |

Millage Taxed |

Dollar Value |

|

|

|

|

| Delaware Valley School

District |

117.83 mils |

$ 2945.75 |

|

Pike County |

24.99 mils |

$

624.75 |

| Dingman Township |

6.5 mils |

$ 162.50 |

| Fire Tax |

1.25 mils |

$ 31.25 |

| Ambulance Tax |

0.5 mils |

$ 12.50 |

How Does

Dingman Township Compare to Neighboring Municipalities?

Not only

does Dingman Township have one of the lowest township

property tax rates in Pike County, but it is quite a

bargain compared to several of it's neighbors. In

2024, Milford Borough taxed its properties 40.85 mils.

(plus an income tax). Matamoras Borough 46.2 mils,

Westfall Township 19.75 mils,(plus

an income tax) Milford Township 14 mils and Delaware Township

13.68 mils.